Definitely not a bank. Just a super-low home loan rate. Woof.

Insanely low rates

No locked-in contracts

Insanely low rates No locked-in contracts

We asked ourselves – what if there was a bank that wasn’t expensive, slow and hard to deal with? Instead, there was a lender that was better, easier and faster. That thought – that’s the moment Neo was born.

Pay less, or pay down faster. You choose.

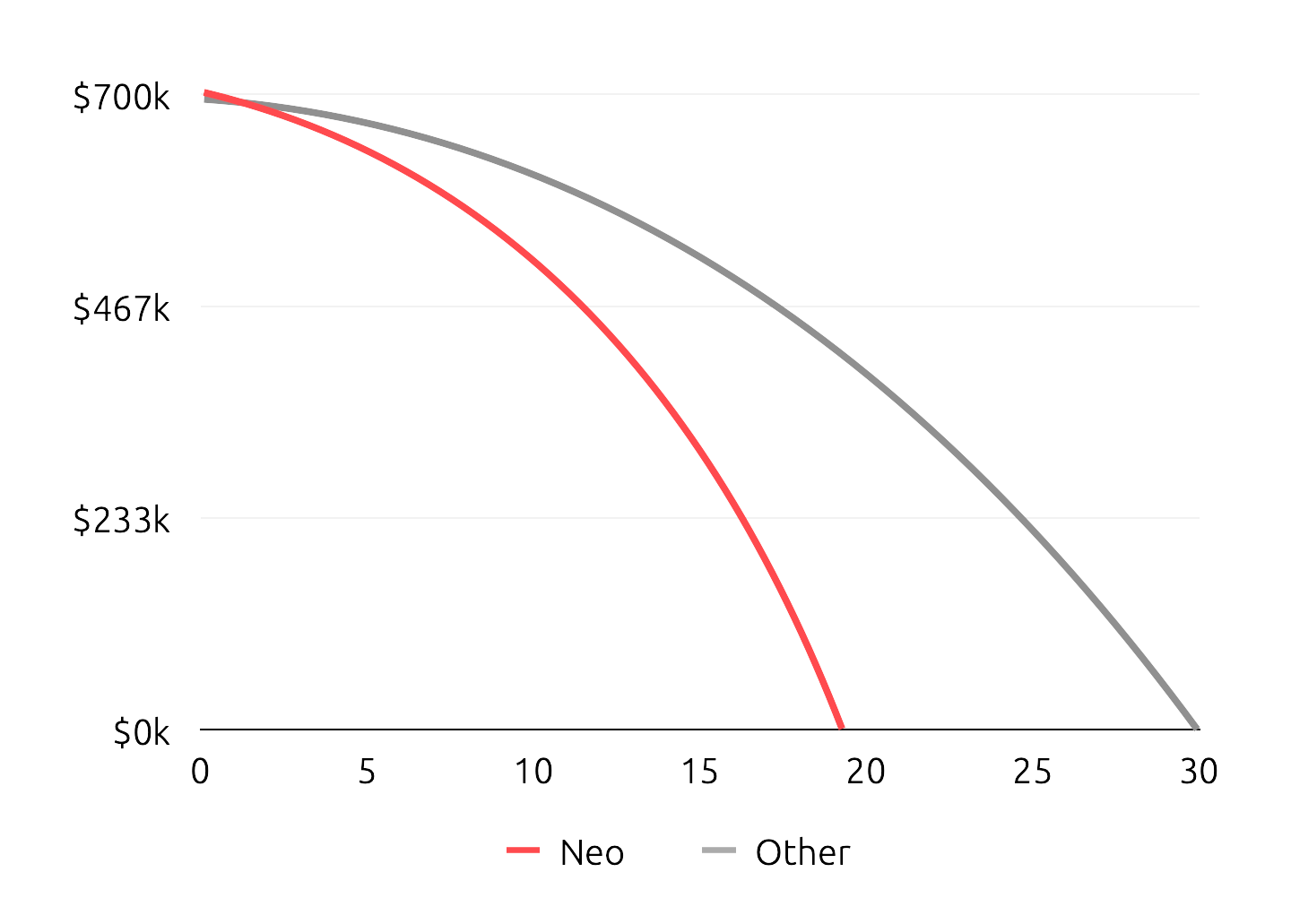

Manage your home loan your way. Keep your current loan repayments the same and pay off your home loan faster or lower your repayments and have more for yourself. With a Neo home loan, you could pay it off up to 11 years faster**

**Based on loan repayments for a $700,000 home loan over 30 years at a low bank floating rate of 7.99% p.a. and a Neo rate of 5.85% p.a. Making the same size loan repayments, the Neo loan will be repaid over 11 years faster taking 18 years and 9 months to be fully repaid. The calculations assume no changes in loan interest rates over the loan term.

Definitely not a bank.

Low rates, less than most banks’ fixed rates

Zero term contracts and no hefty break fees

Fast approval, in as little as 24 hours*

*All applications are subject to Neo's normal credit assessment and loan suitability criteria. Terms, conditions, fees and charges apply. Information provided is factual information only, and is not intended to imply any recommendation about any financial product(s) or constitute tax advice. If you require financial or tax advice you should consult a licensed financial or tax adviser.

Already got a home loan? We’ll sort the switch for you :)

On a $700,000 home loan, you could save over $350,000 in interest*

*Based on a $700,000 home loan over 30 years. Neo loan at 5.85% p.a. Comparison rate based on a typical retail bank low floating rate of 7.29% p.a. Savings assume no changes in interest rates over the loan term.

Let’s trim the fat.

We don’t have branches and other high costs.

Instead, our cost structure is low and our business is agile. We work exclusively with approved, accredited Mortgage Advisers, so you’re always dealing with an expert when it comes to home loans. With Neo, everything is simple and transparent – phew. *

How Neo works

We don’t have branches and other high costs. Instead, our cost structure is low, and our business… agile. Most importantly, we work only with approved, accredited Mortgage Advisers*, so you always deal with a home loan expert. With Neo, everything becomes simple and transparent – how it should be.

*When you apply for a home loan through Neo, you are protected by responsible lending laws. Statements on this website pertaining to home loans are not regulated financial advice. This means that duties and requirements imposed on those who give financial advice do not apply to these statements. In order to obtain a home loan through Neo, you must apply via an accredited Mortgage Adviser who operates under a licensed Financial Advice Provider and will provide you with financial advice. Mortgage Advisers have duties under the legislation which include a duty to comply with a code of conduct and meet competency standards.